Letters to a Founder #1: How is your startup different from all other startups?

How the Passover Seder's "Four Questions" frames how investors think and how you should evaluate your startup

I decided to write this series to help potential founders, who may now be in the position I was in years ago, to evaluate their decisions and better understand the challenges they are about to face. Building a startup is inherently difficult, and most should not attempt it. That's why I ask founders these critical questions before they embark on their journey.

Growing up, we would celebrate Passover every year at my grandmother’s house. For those unfamiliar, Passover is the Jewish holiday commemorating the Exodus from Egypt. During the Passover Seder, we recount the story of this journey, which begins with the youngest person at the table asking the Four Questions (Mah Nishtanah). These questions prompt us to explain why this night is different from all other nights, with the rest of the Seder reflecting on these differences.

In my family, as the only grandchild, it was always my duty to ask the Four Questions—even well into adulthood. By the time I was 30, I was still playing the role traditionally meant for a small child.

But this annual repetition taught me more than just a ritual; it instilled in me a pattern of thinking that I've since applied as both a founder and, more importantly, as an investor evaluating new startups.

Founders must understand this framework, as it aligns their incentives with those of investors. The venture market is a fundamental bargain between founders and investors: one is risking capital in the riskiest asset class so the entrepreneur can pursue an enormous opportunity, aiming to deliver an outsized return.

Therefore I ask myself every time I write a check and risk my capital and reputation to support a founder: Ma nishtanah ha-startup hazeh mikol ha-startupim? or

Question 1: Why is this startup different from all other startups?

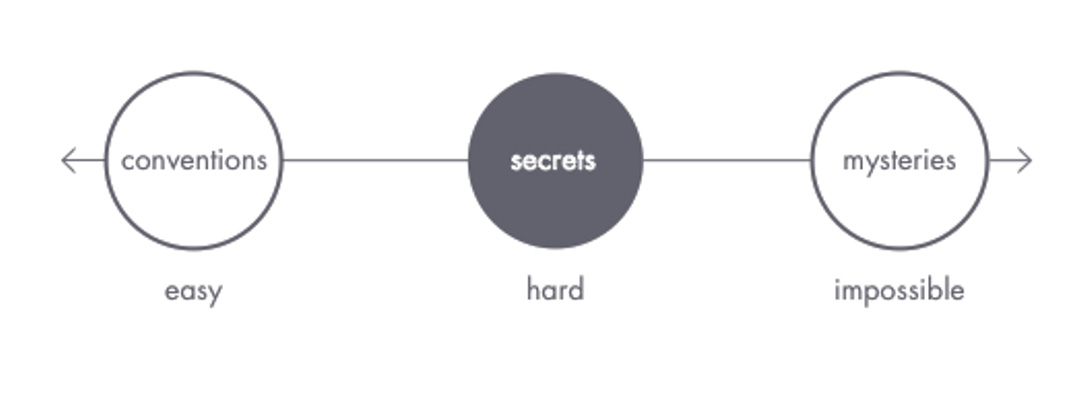

Frankly, most startups fail to satisfactorily answer this question. This question echoes what Peter Thiel calls the “secret” in Zero to One—a core insight that isn’t obvious but also isn’t impossible to achieve. This insight cannot be so obvious that everyone already sees the opportunity—otherwise, it ceases to be a “secret.'“ Nonetheless, it can’t be so far-fetched that it seems unachievable, as that would make it unworthy of pursuit. Your business needs to offer a plausible yet significant “secret”—something that positions your startup to fundamentally change the world. This is the core question for a venture business. If it fails to satisfactorily answer this fundamental question, your venture is not ready. Yet, similar to the Passover ceremony, other questions exist to support and build on this initial core point: why your startup is unique and how it can scale to become an extraordinary, world-changing company.

Question 2: Why is what you say plausible?

Every startup founder has a vision. But vision alone isn’t enough. You need to prove that your vision is realistic, and that requires more than just enthusiasm. You need to show that what you’re claiming is not only bold but also grounded in facts and logic. Investors don’t just want to hear what you think will happen—they need to see why it’s plausible.

This means diving deep into the market: who’s out there, what they’re missing, and why you’re positioned to take advantage of that gap. What’s the size of the opportunity? What do you know that others don’t? Most importantly, what experience or insight do you and your team bring to the table that makes this claim believable? Investors are looking for founders who not only see an opportunity but can also convince them that it's achievable.

If you’ve pitched your idea a few times and it’s not sticking, it’s probably not just because people don’t get it. It’s because you haven’t made the case convincingly enough or looked deep enough at your proposed plan. You must show that your idea isn’t just plausible—it’s inevitable. Your data needs to back up your claims; your assumptions must be tested. People need to walk away feeling that not only is your idea transformative, but it’s also inevitable.

Question 3: Where does the idea stand today?

This question is all about traction. Investors want to see where your idea is at right now—whether you’ve built an MVP, gained paying customers, or made other strides in validating the market. This is where financial models, growth metrics, and a deep understanding of the market opportunity come into play. This, in some cases, does not need to be revenue; rather, the more you can show uptake of your solution and the rate of that, the more you can prove that you may have something transformative.

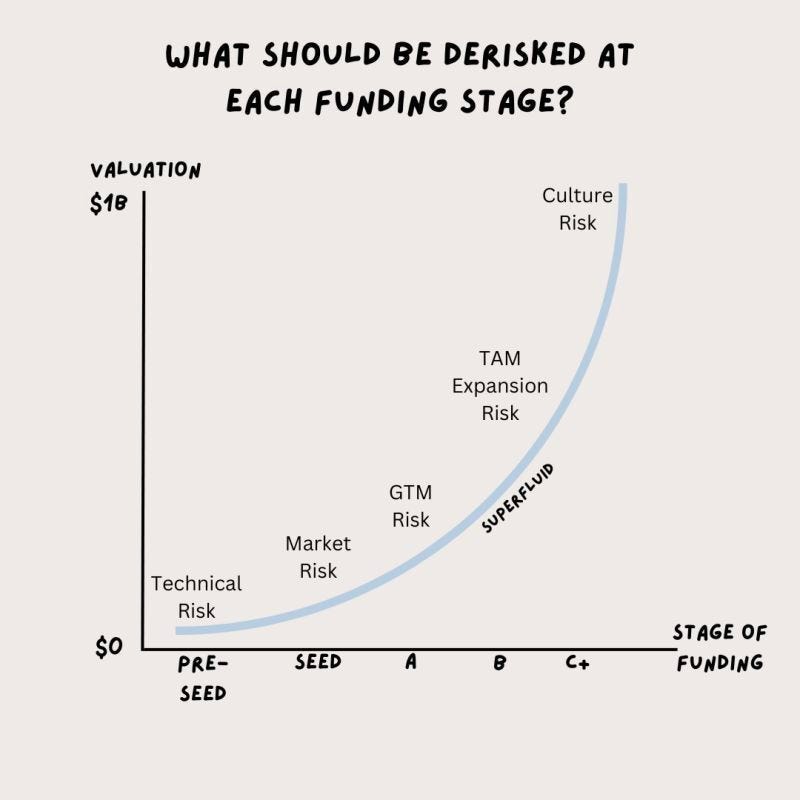

The more traction you can show, the less risk is involved. As your traction grows, the perceived risk diminishes, and investors feel more confident in your ability to hit future milestones. Your ability to demonstrate this progress lowers perceived risk and increases the likelihood of an outsized return.

Question 4: What is the price, and how much are you raising?

This is where the numbers and your ability to manage capital constraints come into play. How much capital do you need, and for what specific purposes? What valuation are you offering? What will this round of funding enable you to achieve, and how will it move you closer to scaling the company? Your funding request should align with what you need to reach your next milestone, so that if you achieve it, you will be able to raise your next round or, ideally, never need to raise again (while in hypergrowth, of course). Furthermore, risk should be in line with your pricing. Uber's Series A funding was at 49 million pre-revenue after it had garnered hundreds of thousands of rides and over 10,000 customers. Today, I see YC startups with little traction raising at $20 million post-money valuations. I find it difficult to underwrite some of these promising early-stage opportunities that haven’t sufficiently de-risked their ventures. Overvaluation early on can set unrealistic expectations, making it harder to raise future rounds and diluting long-term success. This can make it harder to justify future rounds at higher valuations, leaving founders overextended and struggling to raise additional capital. In reality, this often does a disservice to startups and actually increases their perceived risk of not being able to hit their next milestone. Therefore, when the value proposition and the risk level don’t align, it won’t make sense for me to invest.

Conclusion

In the end, the Four Questions serve as more than just a framework for the Passover Seder or a way to assess startups—they’re a way for founders to challenge their own assumptions. Every founder must reflect on their journey and ask: Why is my startup different? Why is what I’m claiming plausible? Where does my idea stand today? And what is the value of the opportunity I’m presenting to investors?

These are not just questions for a pitch but for yourself as a founder. They force you to critically evaluate the unique value of what you're building and ensure you have the foundation to succeed. They are also here to ask if you are ready to carry the expectations of those who entrust you with their money to build something great. While failure is acceptable, the capital you receive is entrusted to you to help build something incredible, which you also need to eventually return at a massive multiple (for me and my stage of investing, I consider a 30x or greater). If, after going through this exercise, you realize your startup doesn’t yet have enough differentiation, plausibility, or traction—that’s okay. The nature of venture capital is that the road is inherently risky and really shouldn’t be for everyone. Either reevaluate to gain the conviction you need to go forward or try an alternate path to build your business.

Remember, most startups will fail. But those that succeed do so because they answer these questions early and honestly. For founders, this process of self-examination can be the difference between being part of the many or standing apart as one of the few that truly matter.